The push for renewable energy in the USA is really picking up steam, and solar energy is shining bright at the front of the pack. The government has launched a bunch of cool incentive programs to get more people to jump on the solar panel bandwagon. These programs are like a helping hand, making it cheaper and easier for homeowners and businesses to go solar. And the best part? They’re not only saving you some serious cash but also making the planet a greener and more sustainable place. So, let’s dig into the different kinds of incentives and how you can make the most of them.Getting to Know Solar Incentives in the USA

Getting to Know Solar Incentives in the USA

Solar incentives are like little gifts that cut down the initial cost of installing solar panels and keep on giving with long-term savings. They come in all sorts of flavors, from federal tax credits to state-specific goodies.

Federal Solar Tax Credit (ITC)

The Federal Solar Tax Credit is a biggie. It lets homeowners knock off 30% of their solar installation costs from their federal taxes. And you’ve got until 2033 to take advantage of it. After that, the percentage will start to go down. The cool thing is, there are no limits on how much you earn or the value of your system. So, pretty much anyone who qualifies can get in on this deal.

State and Local Incentives

Besides the federal credit, states are getting in on the action too with their own incentives. Here’s what you might find:

Tax Credits: These are like the federal ITC but at the state level.

·Rebates: It’s like getting a discount right off the bat from utility companies or local governments.

·Performance-Based Incentives (PBIs): You get paid based on how much electricity your solar system makes.

Take California, for example. They’ve got a Solar Initiative with cash rebates. Maryland, on the other hand, offers up to $1,000 in rebates and a 100% sales tax exemption for solar gear.

Low-Income Solar Programs

The Biden-Harris Administration wants to make sure everyone can get a piece of the solar pie. They launched the Solar for All program, which is putting $7 billion towards helping low-income households go solar. In some cases, it could even be free! The goal is to give 900,000 less fortunate families a chance to save on energy bills and go green.

Net Metering

Net metering is a super handy thing for homeowners. If your solar system makes more electricity than you need, you can send it back to the grid. And guess what? You get credits on your utility bill. Over time, these credits can really add up and cut down your electricity costs.

Solar Renewable Energy Credits (SRECs)

In states with SREC programs, every megawatt-hour your solar panels produce earns you credits. You can then sell these credits to utility companies and make some extra dough.

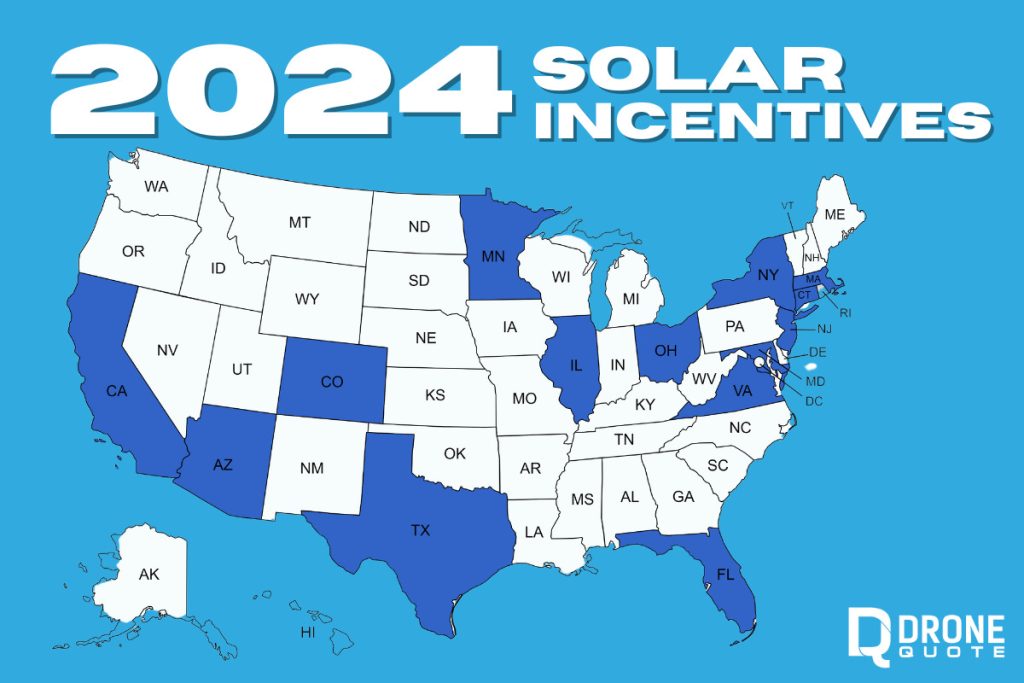

State-Specific Incentives You Don’t Want to Miss

Different states have their own special programs to make solar even more attractive:

·Arizona: They offer a 25% tax credit for installations, up to $1,000, and their net metering policies are pretty sweet.

·California: Cash rebates from the California Solar Initiative and no sales tax on solar purchases.

·Illinois: The Illinois Solar for All program gives free solar installations to eligible low-income households.

·Maryland: You get a combo of sales tax exemptions, rebates, and incentives for energy storage systems.

·Texas: Utility providers like Austin Energy give out rebates up to $2,500 for solar installations.

Since each state’s got its own thing going on, it’s really important to check out what’s available where you live to save the most.

Tips to Maximize Your Solar Incentives

With all these incentives out there, you want to make sure you’re getting the most bang for your buck. Here’s how:

Do Your Local Research

State and local incentives can be all over the map. The Database of State Incentives for Renewables & Efficiency (DSIRE) is a great place to start looking for programs in your area.

Stack Your Incentives

Use both federal and state programs together. For example, combining the 30% federal tax credit with state rebates can make your installation cost a whole lot less.

Timing Is Everything

Some incentives, especially state rebates, are first-come, first-served or have deadlines. So, plan your installation to hit those deadlines and get the most benefits.

Pick the Right Ownership Model

To get the Federal Solar Tax Credit and other goodies, you need to own your solar system. If you lease or go for a Power Purchase Agreement (PPA), you might miss out.

Why Solar Incentives Are a Big Deal

These solar incentives show that the whole country is serious about renewable energy. They make it more affordable to install solar, which means more people will do it. And that means we rely less on dirty old fossil fuels and cut down on greenhouse gas emissions. Homeowners who use these incentives are not only saving money but also being heroes in the fight against climate change.

Wrap-Up

The solar incentives in the USA are like a golden ticket to a more affordable and sustainable energy future. By understanding and using federal, state, and local programs and following these smart tips, you can save a ton on installation costs and even make some money with SRECs.

The road to a sustainable future starts with making smart choices. So, go ahead and check out the incentives in your state and become part of the growing solar-powered family. Let’s all work together to make the world a greener and more beautiful place!